In NMHC’s July Market Trends, we reported how two data sources (the U.S. Census Bureau and CoStar) significantly diverge regarding multifamily construction. Specifically, Census reports multifamily starts (5+ units in structure) increasing in the second quarter – up 6.9% from 1Q 2024 and 22.0% from the year prior—while CoStar data show starts decreasing—down 27.3% from 1Q 2024 and 34.9% from the year prior. Furthermore, the Census Bureau’s latest new residential construction report shows multifamily starts increasing even more in July (11.6% month over month).

So which data source is correct? Are multifamily starts currently increasing or decreasing?

Some industry observers question the validity of the recent Census numbers and not just because they do not comport with statistics produced by private date providers, including CoStar. They note that these figures do not align either with what they see on the ground in their own businesses or with other macroeconomic indicators. Indeed, a drastic upswing in multifamily housing starts seems unlikely in the presence of persistently high interest rates and low rent growth.

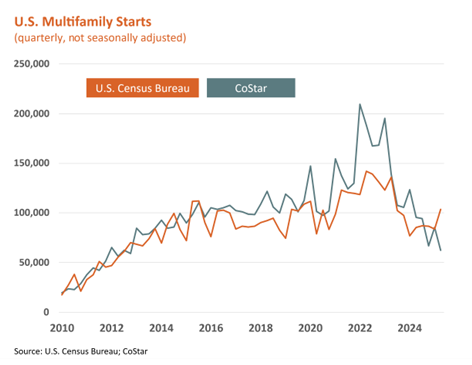

To investigate, we first need to ensure we compare apples to apples in our analysis. While we typically look at “seasonally adjusted” data (data that attempts to correct for any predictable seasonal variation) from the Census, CoStar only reports construction data on a not-seasonally-adjusted basis, which we would expect to be inherently more variable. In the figure below, we instead compare only not-seasonally-adjusted multifamily starts from the two data sources.

We can see that the two series closely tracked between 2010 and around 2016, after which CoStar began to report noticeably higher starts figures. We can also see that CoStar recorded a much steeper increase in multifamily starts between 2020 and 2022 compared to the Census and has since recorded a much steeper decline. The two sources still differ over whether multifamily starts have ticked up or down over the past year: CoStar data show quarterly multifamily starts decreasing 36.5% between 2Q 2024 and 2Q 2025, while Census data show multifamily starts increasing 22.5% during this period.

These differences persist across regions as well. Between 2Q 2024 and 2Q 2025, CoStar data show multifamily starts decreasing 51.7% in the Northeast, 32.8% in the West, 32.4% in the South and 14.6% in the Midwest. The Census, meanwhile, shows multifamily starts (2+ units in structure) increasing 99.0% in the Northeast, 16.4% in the Midwest, 14.3% in the South and 7.2% in the West during this time.

Methodological Differences

The discrepancies between the two data sources likely have to do with their differing methodologies in measuring construction activity.

The Census housing data are survey estimates. Because the Census doesn’t have the resources to count every single housing project started across the country monthly, it relies instead on surveying a sample of permitted projects in just some locations. More specifically, the Bureau’s “Survey of Construction” involves visiting just a sample of permit offices across the U.S. and, from them, drawing another sample of permits issued for new housing to examine which projects have actually been started and completed. This process introduces two separate sources of error associated with the estimates published:

- Sampling Error: Since the Census does not survey the entire population, estimates will vary depending on which sample of locations and permitted projects is selected.

- Non-sampling Error: Non-sampling error encompasses all other reasons why survey estimates may be off—for instance, if a Census field representative makes a mistake in their reporting or if they are unable to determine whether certain projects have been started.

CoStar, on the other hand, attempts to survey every multifamily development in the U.S. (not just a sample), and so its estimates are not susceptible to sampling error. That is not to say, however, that CoStar’s figures are perfect, as they could be skewed by other sources of non-sampling error.

The Bottom Line: Which Source is Best?

Economists never like to say that survey estimates are “wrong,” but recent Census figures may simply reflect certain limitations in the Bureau’s methodology (e.g., a sample that is too small, resulting in high sampling error, or other non-sampling errors).

At the same time, the Census Bureau’s New Residential Housing data may also be picking up something missed by private data providers due to the universe they cover. It’s essential that we don’t allow these inquiries into methodology—made in good faith for the purpose of improving the quality of publicly available data—to be confused for an attack on the integrity of the Census Bureau. The Bureau’s New Residential Construction multifamily series dates to 1964, providing an unmatched, long-term perspective that remains essential for trend analysis, benchmarking and historical context.

Caitlin Sugrue Walter, Ph.D., is SVP and Head of Research and Innovation, with primary responsibility for overseeing NMHC's research efforts. Additionally, Caitlin is an active member of the National Association for Business Economics, a member of Up for Growth’s Advisory Board, the Research Institute for Housing America's Industry Advisory Board, and is a member of the Eastern Panhandle Advisory Council for Girls on the Run of the Shenandoah Valley. Prior to working at the Council, Caitlin was an analyst at a real estate advisory firm. Caitlin has a B.A. and B.S. (Planning and Public Policy, Criminal Justice) from Rutgers University. She also holds an M.A. in Urban and Regional Planning, a certificate in Nonprofit and Non-Governmental Organizations Management, and a Ph.D. in Planning, Governance and Globalization with a concentration on metropolitan economies and development from Virginia Tech.

Caitlin Sugrue Walter, Ph.D., is SVP and Head of Research and Innovation, with primary responsibility for overseeing NMHC's research efforts. Additionally, Caitlin is an active member of the National Association for Business Economics, a member of Up for Growth’s Advisory Board, the Research Institute for Housing America's Industry Advisory Board, and is a member of the Eastern Panhandle Advisory Council for Girls on the Run of the Shenandoah Valley. Prior to working at the Council, Caitlin was an analyst at a real estate advisory firm. Caitlin has a B.A. and B.S. (Planning and Public Policy, Criminal Justice) from Rutgers University. She also holds an M.A. in Urban and Regional Planning, a certificate in Nonprofit and Non-Governmental Organizations Management, and a Ph.D. in Planning, Governance and Globalization with a concentration on metropolitan economies and development from Virginia Tech.  Chris Bruen is Senior Director of Research and Chief Economist, with primary responsibility for aiding in and expanding upon NMHC’s research in housing and economics. Prior to joining the Council, Chris conducted research on the behavioral tendencies exhibited by option traders and served as a contributor to the Shanghai-based business publication, MorningWhistle.com, where he wrote on topics relating to Sino-American economic policy. Chris holds a bachelor’s degree in Finance from The George Washington University and an M.S. in Economics from Johns Hopkins University.

Chris Bruen is Senior Director of Research and Chief Economist, with primary responsibility for aiding in and expanding upon NMHC’s research in housing and economics. Prior to joining the Council, Chris conducted research on the behavioral tendencies exhibited by option traders and served as a contributor to the Shanghai-based business publication, MorningWhistle.com, where he wrote on topics relating to Sino-American economic policy. Chris holds a bachelor’s degree in Finance from The George Washington University and an M.S. in Economics from Johns Hopkins University.