How do maturing loans and declining apartment prices impact the current multifamily market? Dive into this NMHC Research Corner analysis to learn more.

Approximately 12% of all multifamily mortgage debt is expected to mature this year, according to the Mortgage Bankers Association’s 2023 Commercial Real Estate Survey of Loan Maturity Volumes, which means that many owners will either need to pay down their loan balances or refinance at considerably higher interest rates (the 10-Year Treasury Yield has increased nearly 3.9 percentage points from April 2020 to April 2024). As a result, we are watching closely for any signs of rising loan delinquency or distressed sales.

So far, however, we have seen little meaningful change in the share of delinquent multifamily loans or evidence of increasing transactions due to distress.

Multifamily Loan Delinquency Ticks Up but Remains Negligible

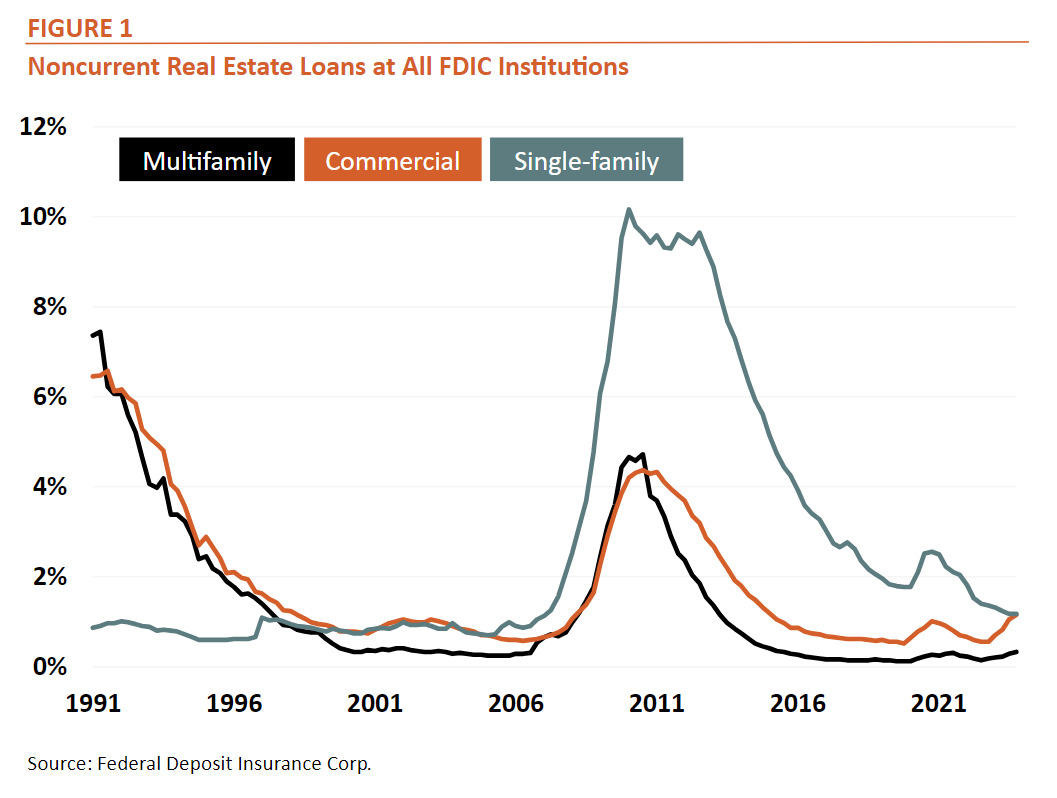

The noncurrent rate for multifamily loans at all FDIC-insured institutions rose three basis points (bps) to 0.32% in 4Q 2023 (latest data available), up 15 bps from a year earlier. For context, the noncurrent rate reached its peak in 1991 at 7.43% and swelled again to 4.71% in 2010 after the collapse of the U.S. housing bubble. Following 2010, the noncurrent rate declined rapidly, reaching an all-time low of 0.11% in the fourth quarter of 2019.

Freddie Mac’s multifamily serious delinquency (60 or more days delinquent) rate edged up from 0.13% in 1Q 2023 to 0.34% in 1Q 2024. Fannie Mae’s serious delinquency rate, meanwhile, rose from 0.35% to 0.44% over the past year. (Freddie Mac only reports loans in forbearance as delinquent if they were delinquent prior to entering forbearance, while Fannie Mae reports all loans in forbearance as delinquent).

Life insurance companies reported a serious delinquency rate of 0.36% in 4Q 2023, up 25 bps from the previous year. The CMBS multifamily delinquency rate (30 or more days delinquent) decreased from 1.91% in March 2023 to 1.84% in March 2024.

One potential area of concern, however, lies with loans extended by debt funds. Debt funds typically provide transitional, floating rate debt with higher rates of leverage than other sources. Debt funds lent aggressively during 2020 and 2021 while interest rates were low and, thus, are more exposed to the recent increase in rates. While we cannot observe debt fund performance directly, many of their loans are packaged and sold via collateralized loan obligations (CLOs), for which we do have data. According to data from Morningstar, the CLO delinquency rate for loans secured by multifamily properties rose from just 1.44% in March 2023 to 7.05% in March 2024. While CLOs do not represent a significant share of overall multifamily loans outstanding, this uptick in delinquency warrants continued monitoring.

To sum up, with the exception of CLOs, we have yet to observe a meaningful amount of loan underperformance among major sources of multifamily debt.

Prices Fall as Apartment Transaction Volumes Continue to Decline

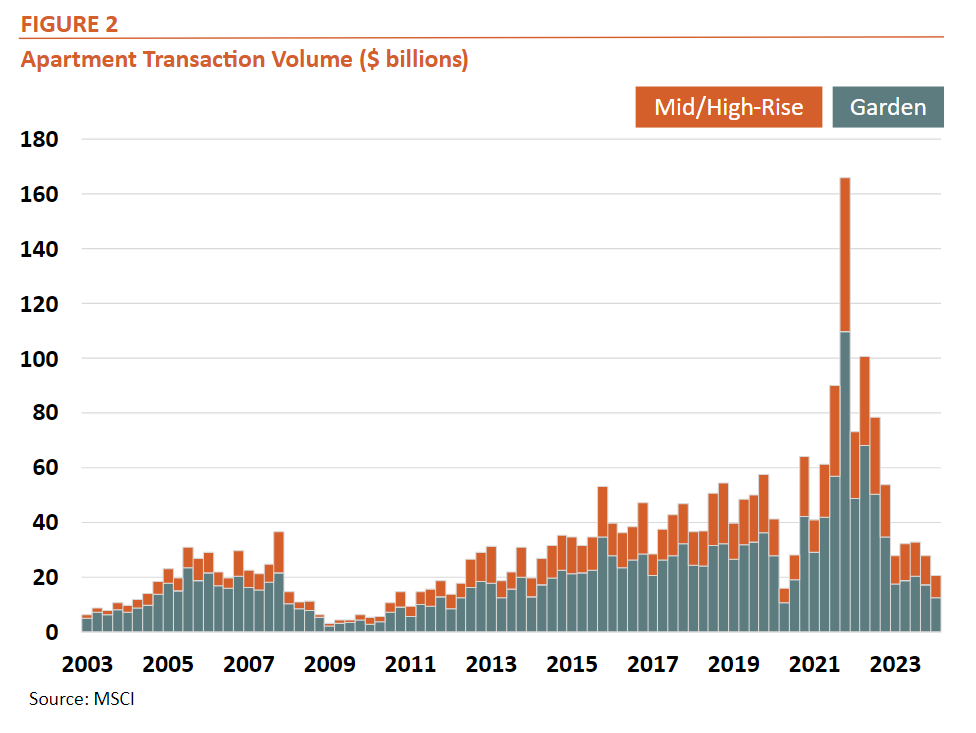

On the for-sale side, rising interest rates coupled with moderating rent growth have translated to a steady decline in apartment prices.

The market value of investment-grade apartments, as measured by the National Council of Real Estate Investment Fiduciaries (NCREIF), fell for six consecutive quarters by a total of 16.7% between 3Q 2022 and 1Q 2024.

The average price per apartment unit similarly fell 21.4% between 2Q 2022 (the highest price on record) and the first quarter of this year, according to data from MSCI, while cap rates increased by a full percentage point during this period to 5.7%.

Still, there is little evidence that distress is driving significant amounts of sales, as transaction volume continues to decrease. In the apartment transaction market tracked by MSCI, sales volume decreased 25.2% from 4Q 2023, and 25.3% from the previous year, to $20.6 billion. This marks the lowest quarterly sales volume since 2Q 2020.

Conclusion

In summary, the multifamily real estate market is at a pivotal juncture, with significant portions of mortgage debt maturing amid rising interest rates. While owners face the challenge of refinancing at higher rates or paying down their balances, the market has yet to show signs of distress. Delinquency rates for multifamily loans have edged up slightly but remain low for most sources compared to historical peaks, and, while apartment prices have decreased, sales volumes also remain well below levels recorded in 2021 and 2022. Nevertheless, it is critical that we continue to monitor these indicators as the year progresses for signs of distress.

NMHC Members: Check out May’s NMHC Market Trends for more information on this topic.>>>