Multifamily deliveries rose to their highest levels in decades in 2023, with many more units in the construction pipeline set to come online this year. Yet, rising interest rates and softening market conditions have caused new construction to pull back sharply. This decline in new construction, as well as the concentration of where recently constructed units are located, is likely to exacerbate our nation’s housing shortage over the longer term. Previous research has shown that housing shortages reverse the apartment filtering process, which increases rents.

Multifamily Completions Surge to Historic Highs

Multifamily completions in the U.S. rose 22.1% in 2023 to 438,500 units, according to data from the Census Bureau, marking the highest number of annual deliveries since 1987. CoStar, similarly, recorded a 26.9% increase in gross multifamily deliveries in 2023.

Much of this apartment construction took place in just a handful of markets. For instance, according to CoStar, the top ten metro areas for multifamily completions were responsible for one third (33.2%) of all deliveries in 2023, while the top twenty metros accounted for half (50.4%) of all deliveries.

Dallas-Fort Worth topped the list, delivering 31,451 multifamily units in 2023, followed by Houston (24,344 units), New York (23,145 units), Atlanta (21,667 units) and Austin (21,261 units).

Of course, 23,145 units delivered in the New York metro area amounts to just a 1.5% expansion of the market’s apartment stock. It is this rate of growth that gives us a much better sense of where apartment construction is highest.

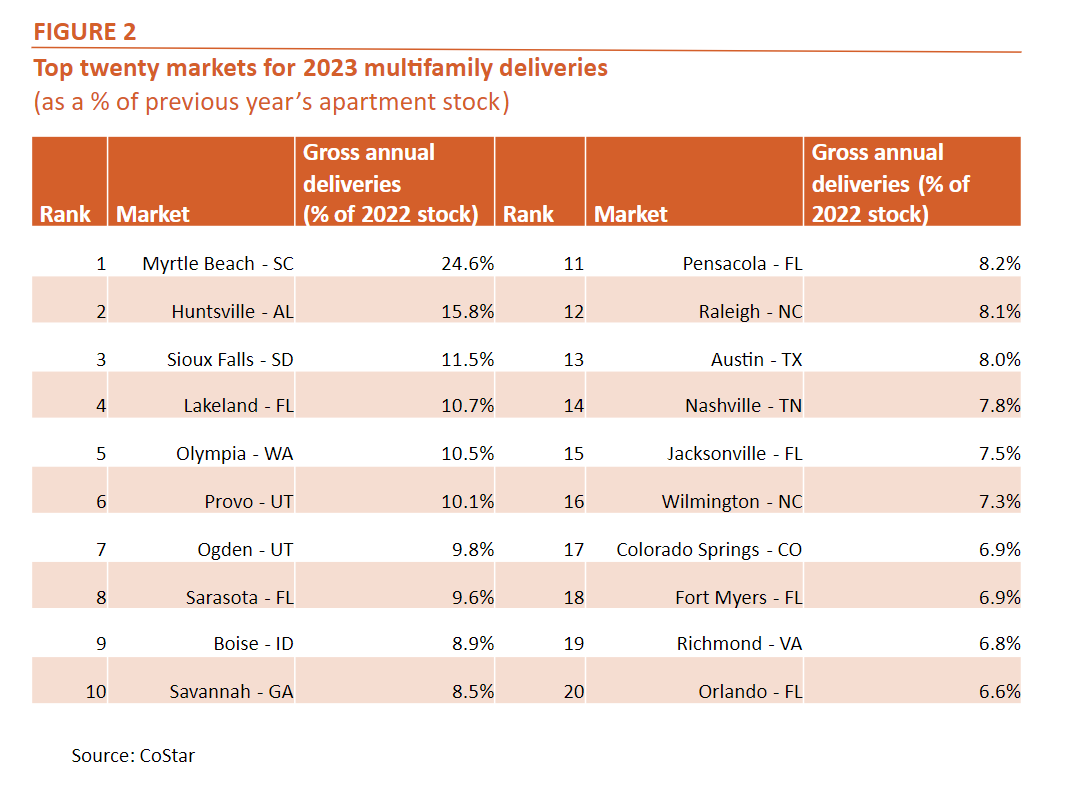

Looking at the 150 largest U.S. CoStar markets by number of apartments, Myrtle Beach, SC delivered the most multifamily units as a percentage of its existing stock (+24.6%), followed by Huntsville, AL (+15.8%), Sioux Falls, SD (+11.5%), Lakeland, FL (+10.7%), and Olympia, WA (+10.5%). Austin, TX stands out as being a top ten market for absolute multifamily deliveries (21,261 units delivered in 2023) that also came in as one of the top markets (number 13) for deliveries as share of its existing apartment stock (+8.0%).

Higher Rates of Deliveries are Unlikely to Let Up in 2024, Resulting in Continued Lower/Negative Rent Growth

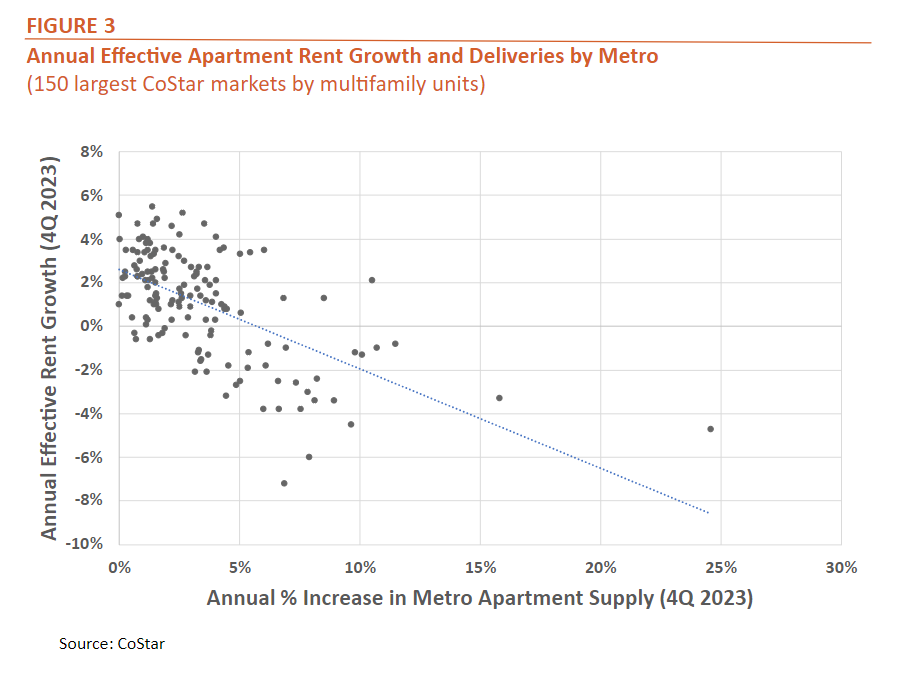

As we pointed out in our December Research Notes, those metro areas that recorded the largest percentage increase in their multifamily supply in 2023 tended to also record lower and at times negative rent growth . This relationship is illustrated in Figure 3 below.

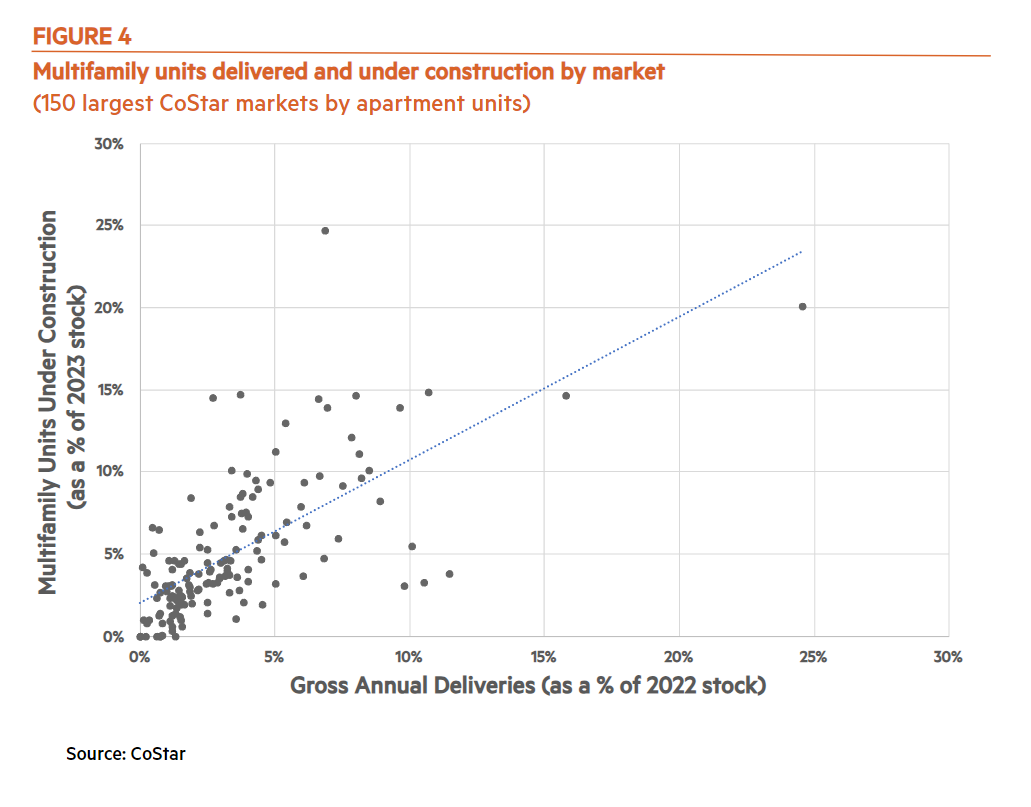

Many of the markets that recorded the highest rates of multifamily deliveries in 2023 have even more units in their construction pipeline that are expected to come online in 2024. Myrtle Beach, SC, for instance – which led all other markets in its rate of multifamily deliveries 2023 – still had 4,339 units under construction at the end of last year, amounting to a fifth (20.1%) of its total apartment stock. Only Fort Myers, FL had more multifamily units under construction at the end of 2023 as a share of its current apartment stock. After Fort Myers and Myrtle Beach, markets with the highest rates of multifamily construction going into 2024 included Lakeland, FL (14.9%), Miami, FL (14.7%), Huntsville, AL (14.6%), Austin, TX (14.6%), and Fort Collins, CO (14.5%). Miami is the only market mentioned here that was not one of the top twenty markets for multifamily delivery rates in 2023. In other words, markets that built apartments at the highest rates in 2023 are largely still building at the highest rate.

Figure 4 above illustrates that, in general, markets with higher rates of multifamily deliveries in 2023 also tended to record higher rates of multifamily construction going into 2024.

Multifamily Starts and Permits Decrease, Causing the Construction Pipeline to Contract

This surge in new apartment supply may prove short lived, however. While multifamily completions rose in 2023, the combination of rising interest rates and softening market conditions caused both permits and starts to pull back sharply . Multifamily permits fell 19.9% to 508,600 units in 2023, according to data from the Census Bureau, while multifamily starts fell 14.2% to 455,500.

While CoStar does not release data on starts, they do report the number of multifamily units under construction. Decreasing multifamily starts, along with increasing deliveries, should result in a decrease in the number of multifamily units under construction. In fact, CoStar data show a 13.9% decrease in the number of multifamily units under construction between 2022 and 2023.

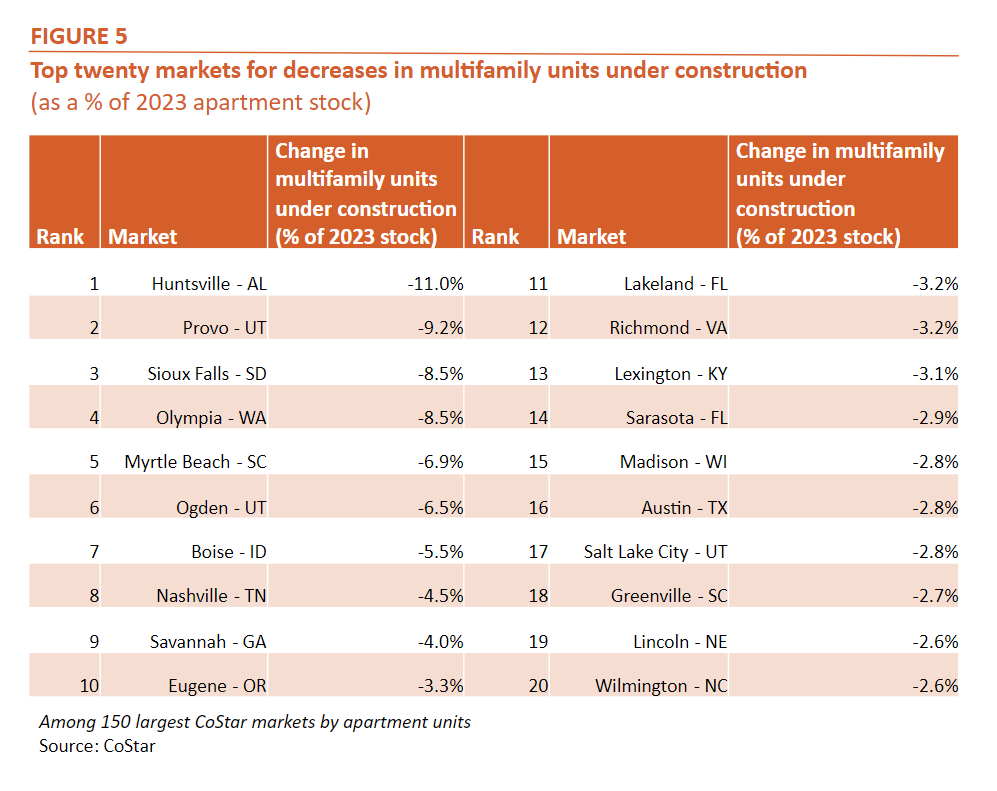

Metros that recorded the largest decreases in multifamily units under construction as a share of total market inventory include Huntsville, AL (-11.0%), Provo, UT (-9.2%), Sioux Falls, SD (-8.5%), Olympia, WA (-8.5%), and Myrtle Beach, SC (-6.9%). Once again, it appears that these are many of the same markets that recorded the highest pace of multifamily deliveries in 2023. In other words, many of the markets that recorded the highest pace of multifamily deliveries in 2023 still lead the nation in the number of units under construction despite seeing a significant reduction in their pipeline.

Takeaways

Multifamily deliveries rose to their highest level in decades in 2023, and construction numbers suggest that this surge in new supply will continue in 2024. Furthermore, those metro areas that have recorded the largest percentage increase in their multifamily supply in 2023 – resulting in lower and/or negative rent growth – also lead the nation in multifamily units still under construction. Yet, it is many of these same markets that have recorded the largest decrease from 2022 to 2023 in the number of multifamily units under construction, driven by rising completions and decreasing starts. Therefore, unless lawmakers enact policies that make it easier to build, it is unlikely that the U.S. – and especially the markets noted in this analysis – will be able to sustain this current elevated level of construction over a longer period of time in order to adequately address our nation’s housing shortage.

Chris Bruen is Senior Director of Research, with primary responsibility for aiding in and expanding upon NMHC’s research in housing and economics. Prior to joining the Council, Chris conducted research on the behavioral tendencies exhibited by option traders and served as a contributor to the Shanghai-based business publication, MorningWhistle.com, where he wrote on topics relating to Sino-American economic policy. Chris holds a bachelor’s degree in Finance from The George Washington University and an M.S. in Economics from Johns Hopkins University.

Chris Bruen is Senior Director of Research, with primary responsibility for aiding in and expanding upon NMHC’s research in housing and economics. Prior to joining the Council, Chris conducted research on the behavioral tendencies exhibited by option traders and served as a contributor to the Shanghai-based business publication, MorningWhistle.com, where he wrote on topics relating to Sino-American economic policy. Chris holds a bachelor’s degree in Finance from The George Washington University and an M.S. in Economics from Johns Hopkins University.