The first months of the Trump Administration have brought a series of new announcements and policy changes, many of which could have an impact on the apartment industry, including changes to immigration policy, the imposition of tariffs and other initiatives. At the state level, new regulations—such as restrictions on rent pricing software, resident screening practices and rent control—have the potential to impact rents as well. However, it can be difficult to determine the impacts as each policy action has multiple moving parts. This uncertainty makes it difficult for housing providers to estimate their future financial conditions and disincentivizes investment, which in turn can impact rents. To attempt to estimate the impact of such policies, one central question can be important: How will this impact housing supply, cost and demand?

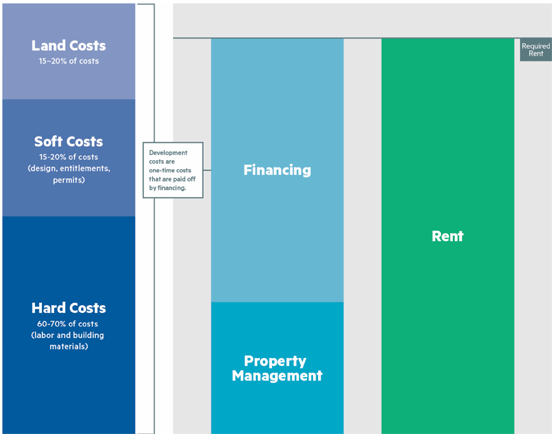

Each individual policy recommendation is distinct and often has never been done before, resulting in unknown impacts. But there are often similar factors that can provide a useful basis to develop an estimate of the impact of a proposed new policy. This image from NMHC’s Housing Affordability Toolkit offers an example of an easy methodology for evaluation. There are various factors that affect whether a property can be built and/or operated. Evaluating the effect a policy has on these factors can help determine the overall impact of the policy.

At its most basic level, to make financial sense and to attract the investment needed to develop and preserve apartment communities, the income generated from the new development must exceed the expenses. This means the expenses cannot exceed what the projected rents—or in the case of existing communities, the actual rents—are for that property. If a proposed policy increases operating expenses for a housing provider, the market conditions must ensure the property can generate sufficient revenue for it to be financially viable and to operate and attract investors that provide financial backing for activities such as major renovations to the property.

Here, we examine several categories of housing policy actions a government could take and their potential impacts on the apartment market.

Costs Related to State and Local Measures Impact Housing Costs

The past few years have seen a proliferation of legislation at the state level intended to address the affordability crisis for residents, but many of these, such as source of income laws and rent control, have unintended consequences that can make affordability worse for renters. Recent research from MetroSight quantifies the financial impact of many of the common state and local regulatory efforts that impact multifamily housing, including source of income laws and eviction moratoriums. These regulations and several others were found to be associated with higher operating expenses in multiple categories, which typically lead to higher rents. If these regulations were alleviated, it would likely improve affordability at a given property level, as well as at a community level.

What about regulations that have been floated that were not included in the research? There are several main takeaways from the research that could be applied to other regulations. For example, does the state or local regulatory structure allow a resident to stay in a unit without being forced to pay rent for an extended period? Or would a proposed regulation require additional reporting requirements from the housing provider? New regulations that would likely have the effects of the ones included in the research could reasonably be assumed to have a similar impact.

NMHC and NAA recently sent a letter to the Trump Administration outlining many Federal regulatory barriers that currently add financial costs to developing and/or operating apartment communities. Many of these barriers result in costly compliance processes, like the regulations identified in the Metrosight research. If these requirements were lessened, that could result in lower staffing costs and lower rents.

How Tariffs Might Impact Supply

The Trump Administration has discussed the possibility of imposing tariffs on several categories of goods from certain countries which could include construction materials. There is no firm proposal on the table at this time, so it is unclear what, if any, impact tariffs would have on rents and housing supply generally. Instead, looking broadly at the concept of tariffs and other actions that have the potential to disrupt the supply chain can provide useful background to estimate potential impact.

If tariffs are imposed on construction and other housing-related goods, housing providers would either pay higher prices for materials or find alternative source countries. We had some experience with supply chain disruptions during the COVID lockdown, where housing providers were forced to pivot due to a lack of materials. During Covid, 52% of all respondents to NMHC’s June 2022 Quarterly Survey of Development and Construction Activity reported delays in development due to shortages of materials. Respondents who saw deals repriced were reporting an average increase of 11%. These delays resulted in steeper financial costs such as the interest on construction loans. In the short term, providers also were forced to pay higher costs to access the materials they needed. In the long term, providers were able to adjust accordingly and identify different sources of materials, but not without cost and delays.

What would the big-picture result be on affordability? Development is already incredibly difficult due to cost—research from NMHC and NAHB found that an average of 40.6% of development costs are attributable to regulations, and the high-interest rate environment has made development very difficult in recent years. Any additional costs or new regulations could push that 40.6% higher, meaning either a new property would need to yield higher rents to be financially viable or it would not be built.

How Federal Employment Layoffs Could Impact Housing Supply

There has been a significant amount of attention paid to DOGE-led efforts to reduce the number of federal employees. It remains unclear how many employees will be terminated or how many jobs will be cut, but we know that some of these individuals reside in apartments. Data from the U.S. Census Bureau’s American Community Survey indicates, unsurprisingly, that the District of Columbia has the highest concentration of apartment residents that are classified as federal employees, at 34%. We also know that the impact is not just going to be felt within the DC metropolitan area. Overall, Pew Research Center analysis of the federal workforce in January 2025 indicates that federal employees are located throughout the country, with the largest numbers of federal employees not located in the District but in Texas (130,000) and California (147,500).

For those employees who remain, the end of remote work has the potential to reshape where individuals live. Some may choose to move closer to their office location, and some may choose to find new employment closer to home. Preliminary numbers from BrightMLS indicates that home listings are relatively higher than in previous years, although it is too early to attribute this to any sort of federal government action, and no discernible uptick is present in CoStar data right now.

In addition to the federal government workforce, it appears that DOGE terminations of contracts and spending are already having a spillover effect—many private consulting firms depend on federal contracts as the core of their business model. Without those contracts, layoffs are likely in these businesses. Data from January and February 2025 indicated 63,583 layoffs were attributed to federal employees and contractors.

What happens to these individuals next has the potential to impact the apartment industry. If they are apartment residents who find another job quickly, there will likely be no impact, unless that job is in another area. They may choose to move back with relatives or may have alternative sources of income (such as a spouse or partner) that create no discernible impact on their living situation.

Interpreting Policy Not Politics

Existing research shows that regulations impact both the development and operations of apartment properties, as well as the communities they are located in. The financial impact of complying with these myriad regulations builds over time. Coupled with high interest rates and rising operating costs, it can be difficult to make properties financially feasible without raising rents. New policies increase uncertainty for housing providers and their financial backers, with the only certainty being that it will likely increase their costs and, as a result, necessitate rent increases.

Caitlin Sugrue Walter, Ph.D., is Vice President of Research, with primary responsibility for conducting NMHC's research on apartment industry trends. Prior to working at the Council, Caitlin was an analyst at a real estate advisory firm. Caitlin has a B.A. and B.S. (Planning and Public Policy, Criminal Justice) from Rutgers University. She also holds an M.A. in Urban and Regional Planning and a Ph.D. in Planning, Governance and Globalization with a concentration on metropolitan economies and development from Virginia Tech. She is an active member of the National Association for Business Economics, a member of Up for Growth’s Advisory Board, and is a member of the Eastern Panhandle Advisory Council for Girls on the Run of the Shenandoah Valley.

Caitlin Sugrue Walter, Ph.D., is Vice President of Research, with primary responsibility for conducting NMHC's research on apartment industry trends. Prior to working at the Council, Caitlin was an analyst at a real estate advisory firm. Caitlin has a B.A. and B.S. (Planning and Public Policy, Criminal Justice) from Rutgers University. She also holds an M.A. in Urban and Regional Planning and a Ph.D. in Planning, Governance and Globalization with a concentration on metropolitan economies and development from Virginia Tech. She is an active member of the National Association for Business Economics, a member of Up for Growth’s Advisory Board, and is a member of the Eastern Panhandle Advisory Council for Girls on the Run of the Shenandoah Valley.