| Market Tightness Index1 | Sales Volume Index2 | Equity Financing Index3 | Debt Financing Index4 | |

|---|---|---|---|---|

|

April 2018 |

38 |

43 |

54 |

36 |

|

January 2018 |

36 |

40 |

58 |

38 |

|

October 2017 |

37 |

45 |

46 |

51 |

|

July 2017 |

43 |

47 |

46 |

47 |

|

April 2017 |

41 |

30 |

42 |

41 |

|

January 2017 |

25 |

25 |

33 |

14 |

|

October 2016 |

28 |

42 |

33 |

38 |

|

July 2016 |

43 |

50 |

44 |

62 |

|

April 2016 |

43 |

53 |

45 |

50 |

|

January 2016 |

47 |

46 |

46 |

37 |

|

October 2015 |

53 |

53 |

52 |

54 |

|

July 2015 |

61 |

53 |

49 |

35 |

|

April 2015 |

58 |

52 |

55 |

60 |

|

January 2015 |

51 |

44 |

55 |

71 |

|

October 2014 |

52 |

58 |

54 |

71 |

|

July 2014 |

68 |

56 |

58 |

68 |

|

April 2014 |

56 |

52 |

53 |

63 |

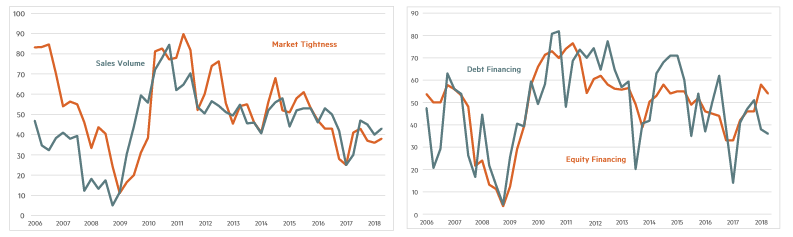

The reported index numbers are based on data compiled from quarterly surveys of NMHC members. Survey responses reflect the change, if any, from the previous quarter. The indexes are standard diffusion indexes, hence are convenient summary measures showing the prevailing direction and scope of changes. They are calculated by taking one-half the difference between positive (tighter markets, higher sales volume, equity financing more available, a better time to borrow) and negative (looser markets, lower sales volume, equity financing less available, a worse time to borrow) responses and adding 50. This produces a series bounded by 0 (if all respondents answered in the negative) and 100 (if all respondents answered in the positive).

1 A Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged.

2 A Sales Volume Index reading above 50 indicates that, on balance, sales volume and the country is increasing; a reading below 50 indicates that sales volume is decreasing; and a reading of 50 indicates that market conditions are unchanged.

3 An Equity Financing Index reading above 50 indicates that, on balance, equity finance is more available; a reading below 50 indicates that equity finance is less available; and a reading of 50 indicates that equity finance availability is unchanged.

4 A Debt Financing Index reading above 50 indicates that, on balance, borrowing conditions are improving; below 50 indicates that borrowing conditions are worsening; a reading of 50 indicates borrowing conditions are unchanged.

For the complete historical series, please visit www.nmhc.org/quarterlysurvey.

INDEX TRENDS

SURVEY QUESTIONS

| Question #1: How are apartment market conditions in the local markets that you watch? “Tight” markets are defined as those with low vacancies and high rent increases. Conditions obviously vary greatly from place to place, but on balance, apartment market conditions in your markets today are: | ||||

|---|---|---|---|---|

|

|

April 2018 | January 2018 |

|

|

|

Tighter than three months ago |

14% | 14% |

14% |

|

|

Looser than three months ago |

38% | 42% |

40% |

|

|

About unchanged from three months ago |

47% | 42% |

45% |

|

|

Don’t know or not applicable |

1% | 2% |

1% |

|

|

Question #2: What about sales of apartment properties in the local markets you watch? The sales volume (number of deals) currently is: |

|||

|

|

April 2018 |

January 2018 |

October 2017 |

|

Higher than three months ago |

18% |

19% |

19% |

|

Lower than three months ago |

32% |

38% |

28% |

|

About unchanged from three months ago |

48% |

38% |

47% |

|

Don’t know or not applicable |

2% |

5% |

5% |

|

Question #3: What about equity financing for apartment acquisition or development? Considering both price and non-price terms, equity financing today is: |

|||

|

|

April 2018 |

January 2018 |

October 2017 |

|

More available than three months ago |

17% |

27% |

9% |

|

Less available than three months ago |

9% |

11% |

17% |

|

About unchanged from three months ago |

60% |

51% |

62% |

|

Don’t know or not applicable |

14% |

12% |

12% |

|

Question #4: What about the conditions for multifamily mortgage borrowing? Considering both interest rates and non-rate terms, compared to three months ago: |

||||

|

|

April 2018 |

January 2018 |

October 2017 |

|

|

Now is a better time to borrow |

10% |

11% |

14% |

|

|

Now is a worse time to borrow |

37% |

36% |

12% |

|

|

About unchanged from three months ago |

44% |

45% |

62% |

|

|

Don’t know or not applicable |

9% |

8% |

12% |

|

Note: The April 2018 Quarterly Survey of Apartment Market Conditions was conducted April 9-April 16, 2018; 130 CEOs and other senior executives of apartment-related firms nationwide responded. The January 2018 Quarterly Survey of Apartment Market Conditions was conducted January 16-January 23, 2018; 144 CEOs and other senior executives of apartment-related firms nationwide responded. The April 2017 Quarterly Survey of Apartment Market Conditions was conducted April 10-April 17, 2017; 140 CEOs and other senior executives of apartment-related firms nationwide responded.