By Chris Bruen

Chris Bruen is Senior Director of Research at the National Multifamily Housing Council (NMHC) in Washington, D.C. He can be reached at cbruen@nmhc.org.

The U.S. doesn’t have enough housing. Freddie Mac estimated that we were short 3.8 million units at the end of 2020, while a recent NMHC and NAA study found a shortfall of approximately 600,000 apartment units in 2021. Yet, many NIMBYs argue that additional development is unnecessary when the U.S. already has so many vacant homes sitting idle. There were, after all, 14.6 million vacant housing units in 2021, according to American Community Survey microdata.

This edition of Research Notes explains why the NIMBYism belief is misguided:

- Many vacant units in the U.S. are only vacant temporarily—often just for a month or two—as households move and search for new homes;

- Homes that are vacant for longer periods of time are often older and in need of repairs—meaning, many provide sub-par living conditions;

- Some amount of vacancy is necessary for a well-functioning housing market—allowing households to move when and where they would like—and we are likely well below this desired rate; and

- Vacant units that are being used as seasonal/recreational homes are highly concentrated in vacation hotspots, not necessarily where people live and work.

Vacant Units for Sale or for Rent Are Only Vacant Temporarily

Nearly a third (30.0%) of vacant units in the U.S. were only vacant temporarily in 2021, according to American Community Survey data, as households moved and searched for new homes. More specifically:

- 16.7% of vacant units were rental homes listed for rent;

- 3.6% were homes that were already rented but not yet occupied by the new resident;

- 5.1% were homes for sale; and

- 4.5% were sold but not yet occupied by the new owner.

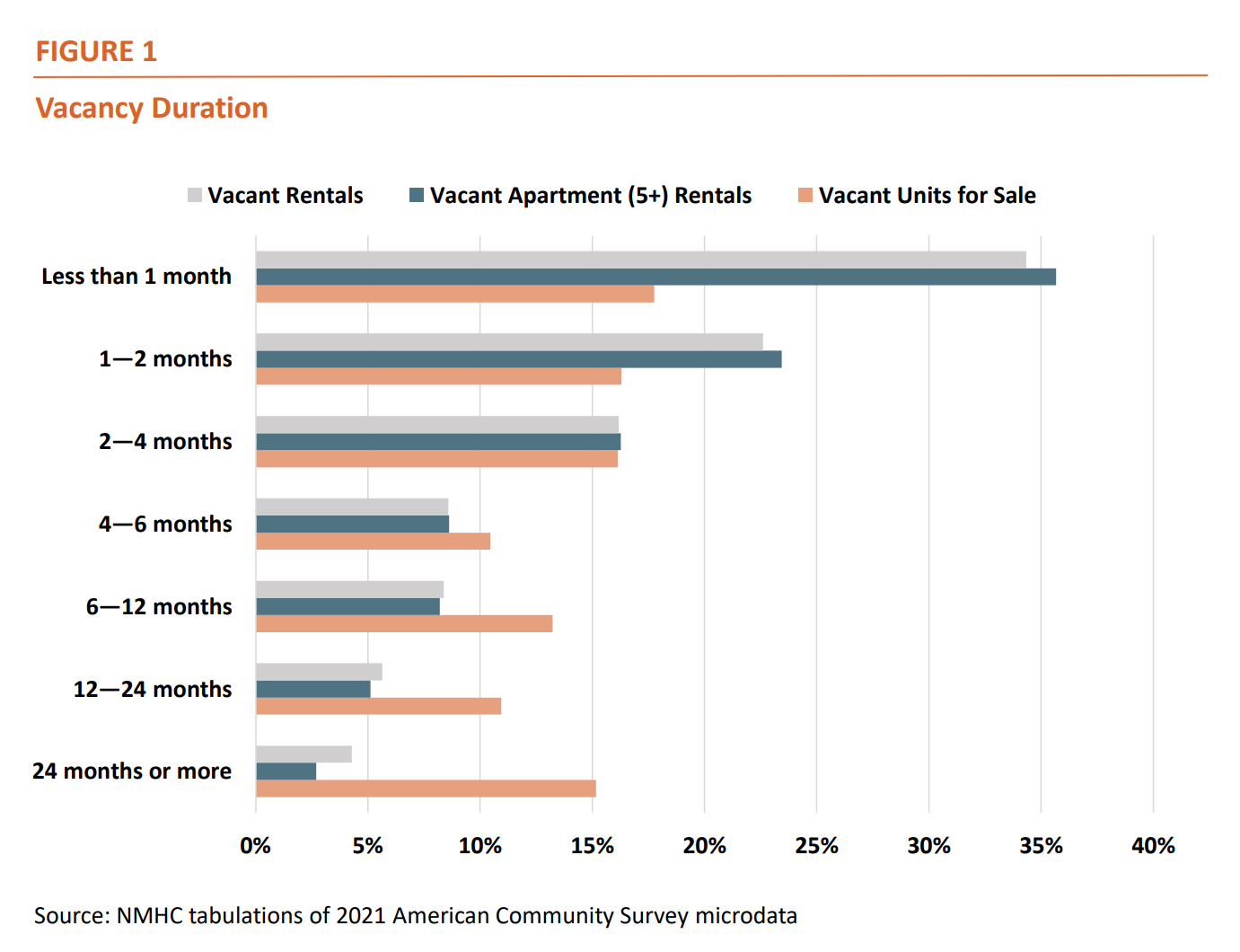

Furthermore, vacant homes that are for rent or for sale typically do not remain vacant for long. More than a third (34.3%) of vacant rental units in 2021 were only vacant for less than one month at the time they were surveyed, while more than half (56.9%) had been vacant for less than two months. Meanwhile, just 9.9% of vacant rental units—approximately 295,000 in total—were vacant for more than a year.

Units for sale tended to be vacant for a bit longer than their rental counterparts. In 2021, 17.8% of vacant units for sale or sold were vacant for less than one month at the time they were surveyed, just over a third (34.1%) had been vacant for less than two months, and 26.1% were vacant for more than a year.

Some Vacant Units Need to Be Renovated or Repaired

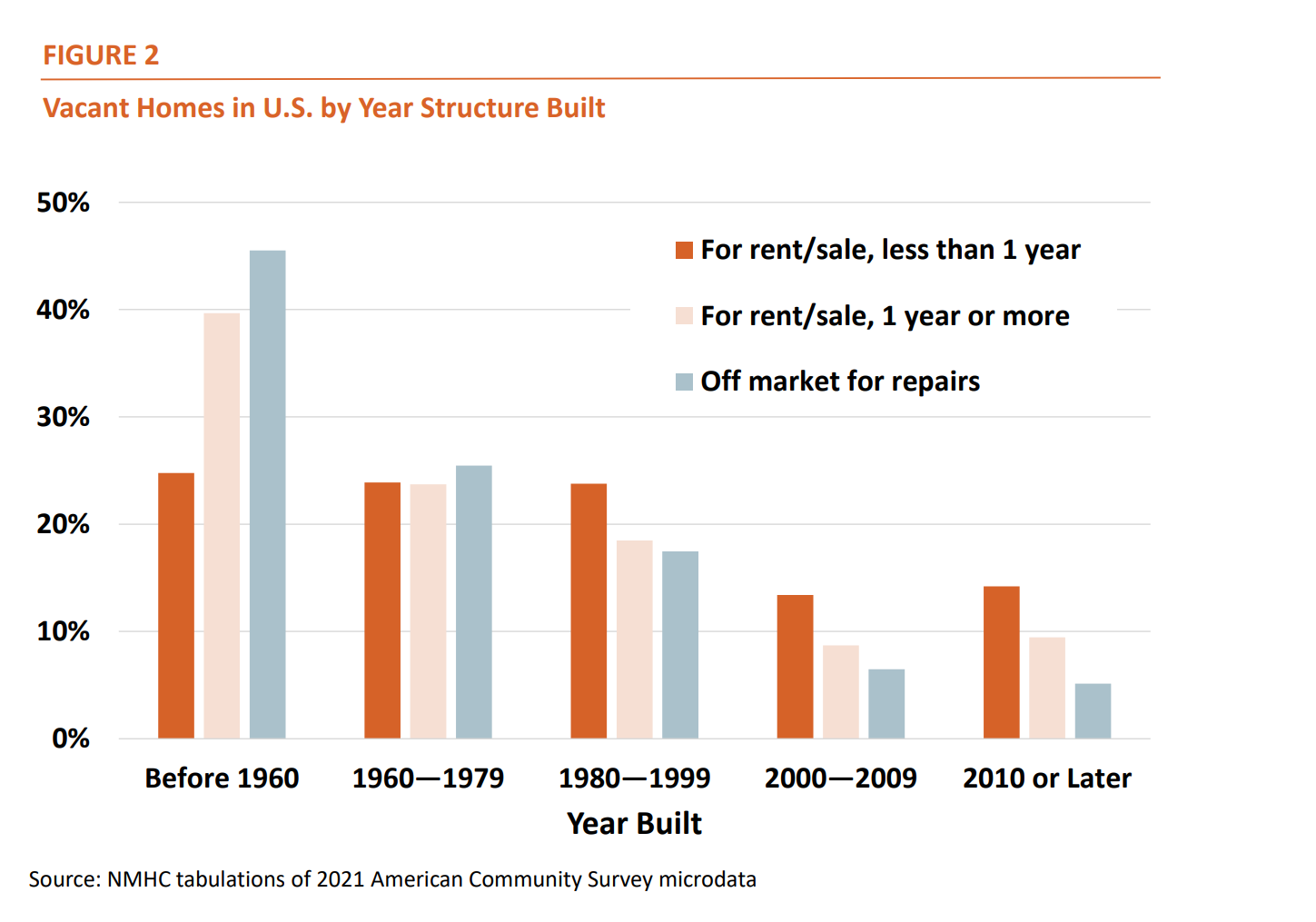

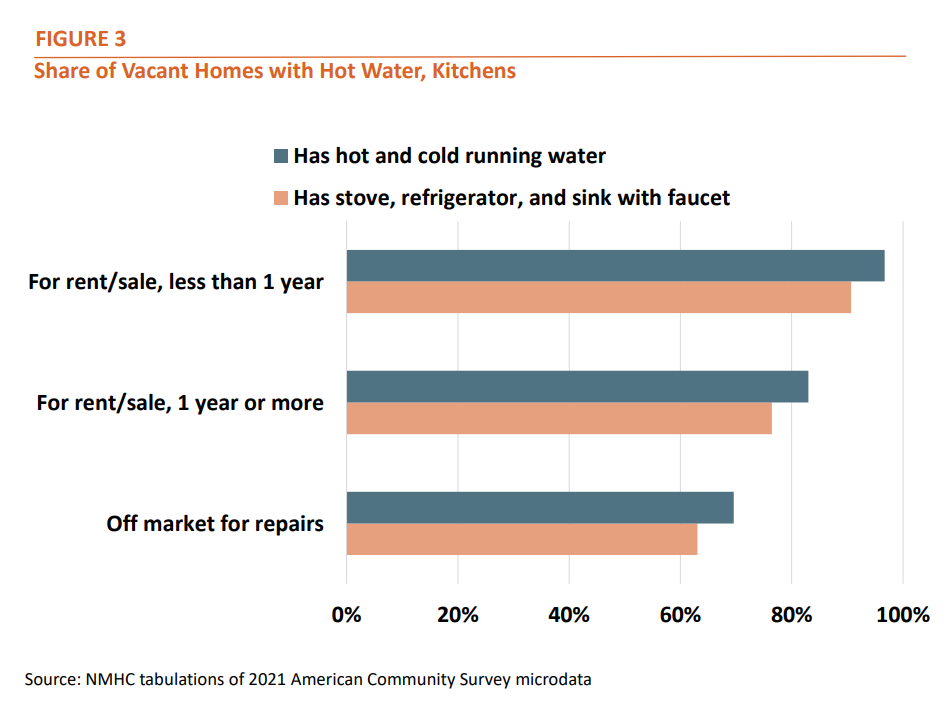

Those homes for rent or for sale that were vacant for more than a year in 2021 tended to be in older buildings and were less likely to offer necessary features such as kitchen facilities or hot and cold running water. This highlights the importance of maintaining and renovating our nation’s aging housing stock.

Meanwhile, more than 1.6 million vacant units in 2021 (or 11.0% of all vacant units) were held off the market entirely because they either needed repairs (5.3%) or were being repaired or renovated (5.7%) at the time they were surveyed.

These units being repaired—even more so than longer-term vacant units for sale or for rent—were much more likely to be in older buildings and less likely to have full kitchens or hot and cold running water.

Some Rate of Vacancy is Necessary for a Well-Functioning Housing Market

The previous two sections should illustrate the importance of having some amount of vacancy in the housing market:

In order to buy or rent a new home, there must be some number of vacant homes available. If there are too few homes on the market, you may have to settle for a home that isn’t quite the right fit, pay a higher price to outbid other potential buyers/renters, or simply choose not to move. Without vacant homes, households would only be able to move if they agreed to switch homes simultaneously, which clearly is not practical.

Moreover, we wouldn’t want people to have to occupy homes that are in dire need of repairs or renovations.

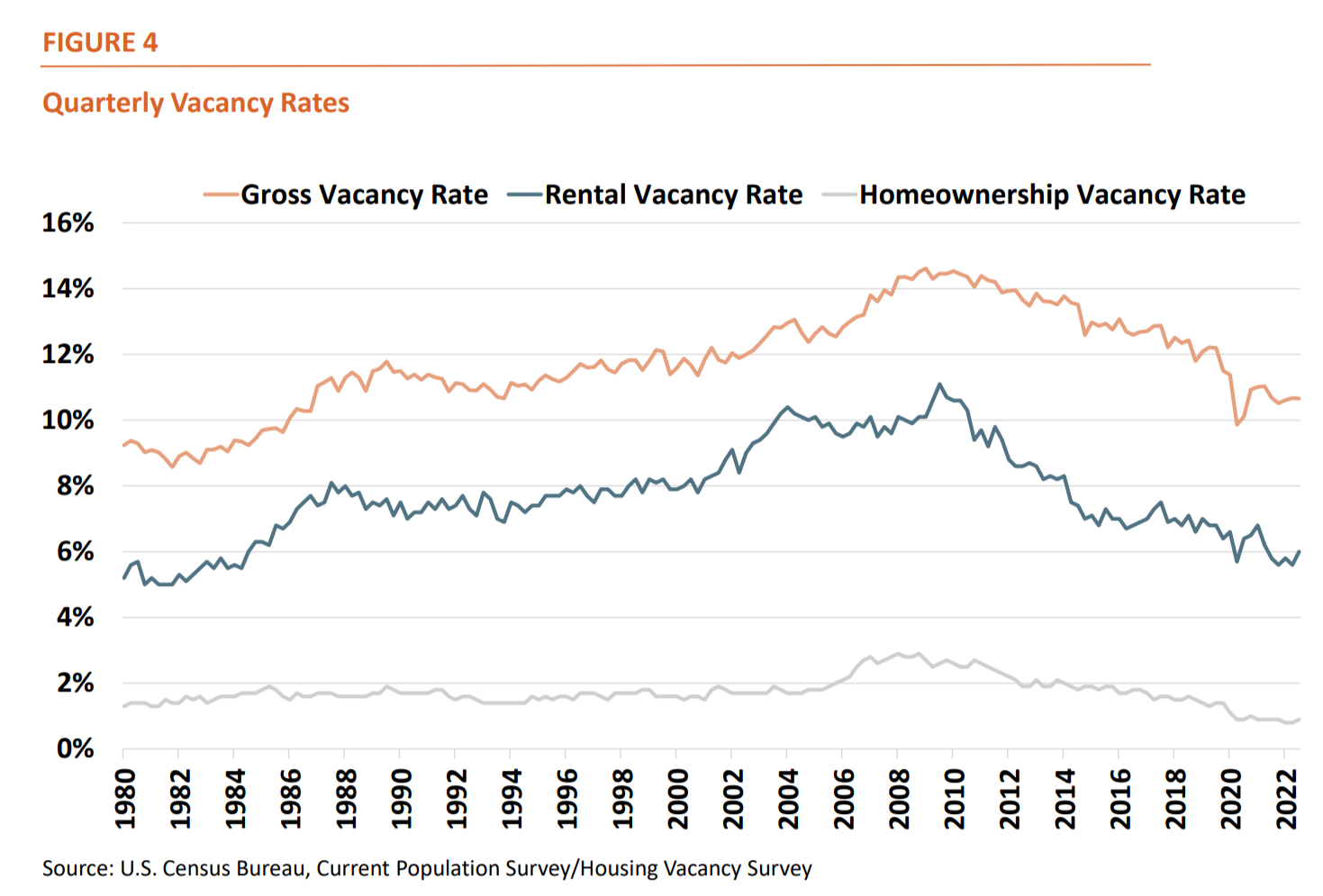

And, while 14.6 million vacant units may seem like a lot, this is near the lowest rate of vacancies we’ve seen in decades.

- The rental vacancy rate—or the ratio of vacant rental units to all rental homes—decreased from a peak of 11.1% in 3Q 2009 to 5.6% in 4Q 2021 and 2Q 2022, the lowest rate since 1984. The rental vacancy rate ticked up slightly from this historical low to 6.0% in 3Q 2022.

- The homeownership vacancy rate decreased from a peak of 2.9% in 4Q 2008 to 0.8% in 1Q 2022 and 2Q 2022, the lowest rate since records began in 1956. The homeownership vacancy rate then edged up to 0.9% in 3Q 2022.

- The gross vacancy rate—the ratio of all vacant units to all housing units—decreased from a peak of 14.6% in 1Q 2009 to 9.9% in 4Q 2020, the lowest rate since 1985. The gross vacancy rate has since increased to 10.7% in 3Q 2022.

Vacation Homes are Highly Concentrated in Certain Areas

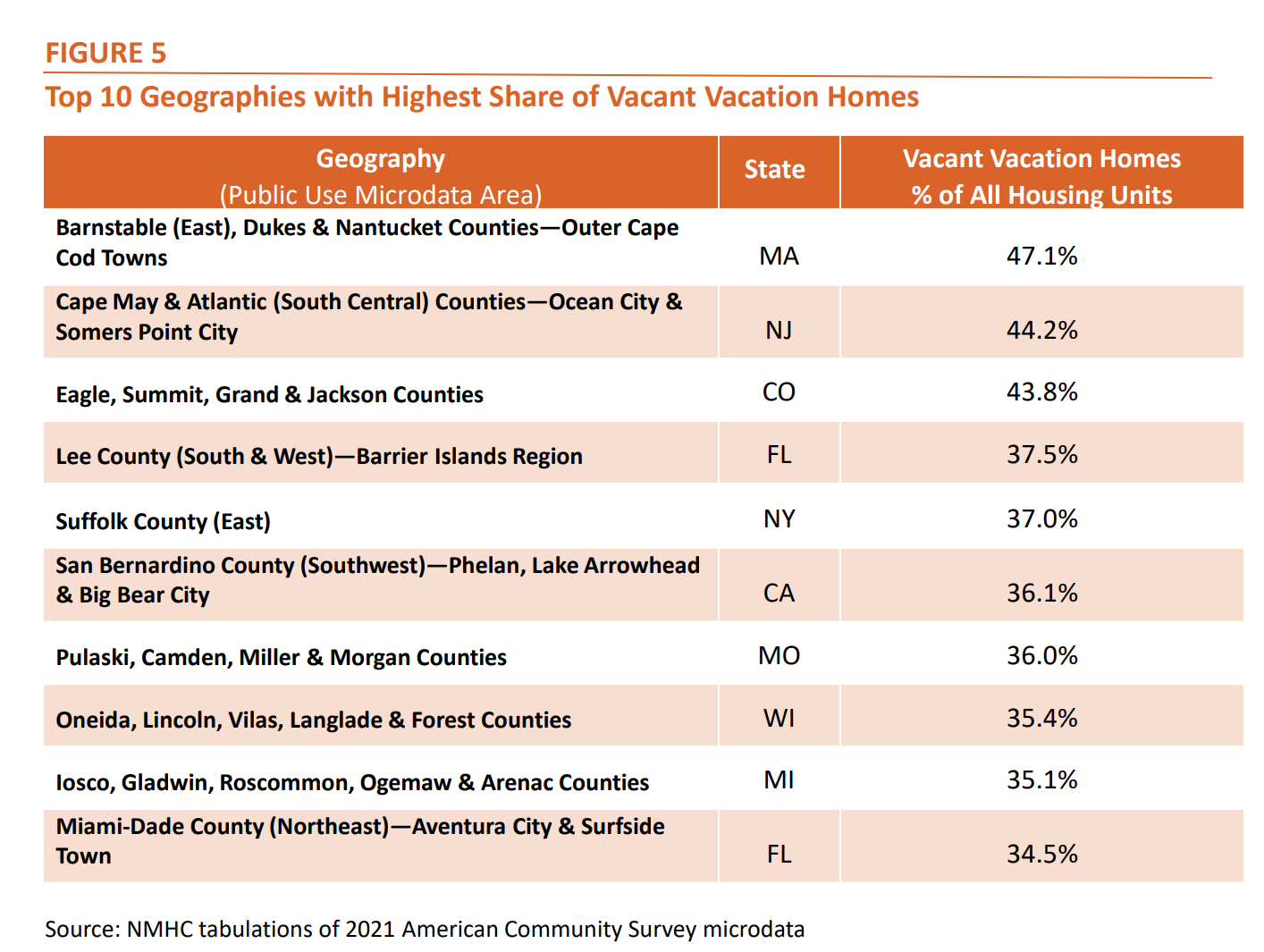

Vacation homes—or units that are held for seasonal, recreational, or occasional use—made up nearly one third (32.7%) of U.S. vacant homes in 2021 and 3.4% of all housing units, more numerous than the combined number of vacant homes listed for rent or for sale. Yet, recreational homes tend to be highly concentrated in certain vacation hotspots. For instance, vacation homes made up nearly half (47.1%) of all housing units in Nantucket and Outer Cape Cod towns in Massachusetts; 44.2% of all housing units in Cape May & Atlantic (South Central) Counties, NJ; 43.8% of housing units in Eagle, Summit, Grand & Jackson Counties, CO; and 37.1% of units in the Barrier Islands Region of Florida.

For reference, vacation homes made up a relatively small share of housing units in major cities such as:

- Boston (2.0% of all housing units);

- Chicago (0.7%);

- Denver (1.1%);

- Los Angeles (0.9%);

- New York City (2.0%);

- Philadelphia (0.5%);

- Phoenix (1.1%);

- San Diego (1.8%);

- San Francisco (2.4%);

- Seattle (1.1%); and

- Washington, D.C. (0.8%).

One city that did stand out, however, was Miami, where vacation/seasonal vacancies accounted for 6.0% of all housing units and 11.4% of all multifamily (5+) units in 2021.

In other words, vacant vacation/seasonal homes generally aren’t very abundant in areas where most people live and work. Yet, they are integral to the economies of many beach and resort towns.

Conclusion

There were nearly 15 million vacant homes in the U.S. in 2021—amounting to more than 10% of the total housing stock. But this was not some reserve of idle homes that could easily be tapped to address our nation’s housing shortage. Many (30.0%) of these homes, for instance, were only vacant temporarily while they were marketed to prospective buyers and renters, while others (11.0%) needed to complete renovations and repairs before they could be put back on the market. A well-functioning housing market needs some level of vacancy to allow households to move when and where they want.

An additional third (32.7%) of vacant units were being used as vacation or seasonal homes in 2021, while the remaining 26.3% were vacant for a variety of other reasons (e.g., foreclosure, legal proceedings, and family reasons) that cannot always be easily or quickly remedied.

The only meaningful way to address our housing shortage—and to ease the cost of housing—is to build more of it and double down on efforts to renovate and preserve our existing, aging stock.

About Research Notes: Published quarterly, Research Notes offers exclusive, in-depth analysis from NMHC's research team on topics of special interest to apartment industry professionals, from the demographics behind apartment demand to the effect of changing economic conditions on the multifamily industry.

Questions or comments on Research Notes should be directed to Chris Bruen, Sr. Director of Research, NMHC, at cbruen@nmhc.org.