By Jim Lapides, SVP and Head of External Affairs

Jim Lapides is SVP and Head of External Affairs, where he leads award-winning, multidisciplinary initiatives that support thriving rental communities across the country. Before joining NMHC, he held positions at the American Society of Landscape Architects and the National Association of Home Builders, and worked with Department of Defense, the Department of Transportation and AARP while at FleishmanHillard. He holds a B.A. from Denison University and a M.A. from Johns Hopkins University.

For years, the NMHC Quarterly Survey of Apartment Market Conditions has provided a snapshot of the apartment market, including trends in sales, equity financing and debt financing. In the first survey of 2026, NMHC included a special question examining the impact of rent regulation.

NMHC compared this year’s results to those of our January 2022 survey. The comparison shows that over the last four years:

- The share of respondents who said they have cut back on investment or development in rent-controlled markets increased from 26% to 35%.

- The share who said they do not operate in these markets and would not consider doing so because of the threat of rent control also increased from 32% to 41%.

- The share who said they have made no changes so far but are considering cutting back in these markets remained at 15%.

This means that the total share of respondents who have altered their investment or development decisions – or are considering doing so – has increased from 73% of respondents in January 2022 to 91%, nearly all the respondents to our January 2026 survey.

Only 7% of respondents this round said they do not plan any change in investment or development in markets affected by rent regulation (down from 23% last round), and only 2% said they do not operate in these markets but would consider doing so despite the threat of rent control (down from 4% four years ago). These findings come as broader apartment market conditions continue to ease nationwide.

What They’re Saying: Rent Control and Housing Affordability—Experts and Local Leaders Voice Concerns

Affordability, particularly housing affordability, has moved to the forefront of public debate. While rent control is once again being promoted as a remedy for rising housing costs, policymakers and economists have increasingly and consistently warned that rent control is a failed solution.

In recent weeks, a broad range of economists, housing experts, and elected leaders from across the political spectrum have renewed those concerns, arguing that rent control ultimately worsens affordability by constraining supply. The following are a small sample of the media coverage and opponents of rent control that are currently being seen across the nation.

What the Twin Cities Tell Us About Fixing the Housing Crisis

The Wall Street Journal, December 15, 2025

By: Rebecca Picciotto

St. Paul enacted rent controls, and housing construction plummeted. Next-door Minneapolis generated a downtown boom without regulating rent.

“Dueling approaches over how to fix America’s housing crisis are splitting Minnesota’s Twin Cities. In 2022, St. Paul enacted one of the strictest rent-control regimes in the country. The ordinance capped annual rent increases at 3% for most apartments, even empty ones. It didn’t adjust for inflation."

“Across the Mississippi River, Minneapolis steered clear of rent control. Instead, city officials strictly focused on creating new housing. A package of land-use revisions in 2020 made it easier to build apartments, in part by removing restrictions that limited housing to single-family homes."

“Now, the results are coming into focus. Permits to build apartments in St. Paul plummeted by 79% in early 2022 from the year before, according to data from the Department of Housing and Urban Development. Real-estate investment activity nearly froze. Developers halted new projects as lenders pulled back. Property values declined as investment cooled.”

“In Minneapolis, meanwhile, developers kept building. Housing permits surged nearly fourfold in early 2022 from the year before. Downtown hubs blossomed as new apartments hit the market and attracted young professionals.”

“More people are recognizing that rent control doesn’t work.” – Jacob Frey, Mayor of Minneapolis

“It was full stop in St. Paul,” said Ari Parritz, a developer in both of the Twin Cities. “People put their pencils down and left.”

Read the full article about the Twin Cities.

New Study Finds Rent Control Harms Housing Supply and Choice for Residents

The Providence Foundation

January 8, 2026

Recently, The Providence Foundation announced findings from an extensive report on rent control policies and found that rent control policies have consistently had negative long-term impacts on housing markets, including reducing supply and worsening overall affordability.

Key Findings:

- Rent Control does not lower rents. It offers no immediate relief for those already struggling with high monthly payments and can incentivize landlords to raise rents to the absolute legal maximum every year.

- Rent Control’s benefits are untargeted, tying the largest subsidies to the most expensive housing. In a 3% rent cap scenario, a tenant paying rent of $3,000 per month would realize three times the annual savings ($1,584) of a tenant paying $1,000 per month ($528).

- Price caps swiftly chill housing production. St. Paul, Minnesota saw multifamily permits plummet 86.2% in a single quarter following its 2021 ordinance.

- Revenue caps disincentivize maintenance and encourage condo conversions. San Francisco's rent-controlled housing supply fell 15% as landlords avoided regulation through conversions, while 64% of controlled units in New York City were found to have maintenance deficiencies.

- Rent control devalues the tax base, triggering a potential tax shift onto homeowners. As rental property values plummet—evidenced by a 5.4% reduction in Portland, Maine's tax base—cities must either raise property tax rates or cut essential local services to offset the revenue gap.

- Supply-side reforms and rental assistance outperform regulations. Zoning changes in Austin, Texas cut rents by 22 percent, while Boston’s rental assistance program surpassed Seattle’s mandates in preventing displacement.

- Tax stabilization agreements and commercial-to-residential conversions are essential for unlocking housing supply. Boston and Philadelphia successfully use these incentives to make redeveloping underutilized commercial and industrial assets financially viable for developers.

“Leaders across the city all want housing to be more affordable. However, it’s clear that rent control is not the way to achieve this goal. In fact, rent control may result in increased rents on uncontrolled units, a reduction in available rental units, and less affordability throughout the market.”

— David Salvatore, Executive Director of The Providence Foundation

Read more about the report.

Healey's mind made up on rent control: ‘I'm a no'

NBC Boston, December 24, 2025

By: Ella Adams

Massachusetts Gov. Maura Healey says housing affordability is a priority, but she opposes a potential 2026 ballot measure on rent control

Asked Tuesday by "Boston Public Radio" host Jim Braude about whether she'd support the measure, Healey said, "Look, I understand the need, the interest in rent control, right? I mean, it's why I've worked really, really hard, Jim, to build as many houses as I can."

"We've got more work to do, but I'm trying to do everything I can to drive down housing costs, which drives down housing prices, but also rent. My concern, you know, rent control is not going to be the solution to how we get through this crisis. We need to build more homes," Healey said.

"I'm a no, because if you look at the studies — if you look at the studies, you effectively halt production. I will tell you that investors in housing have already pulled out of Massachusetts because they're concerned about rent control," Healey added.

Read the full article.

MoCo Multifamily Permits Drop 96 Percent with Rent Control

The Montgomery Perspective, January 6, 2026

By: Adam Pagnucco

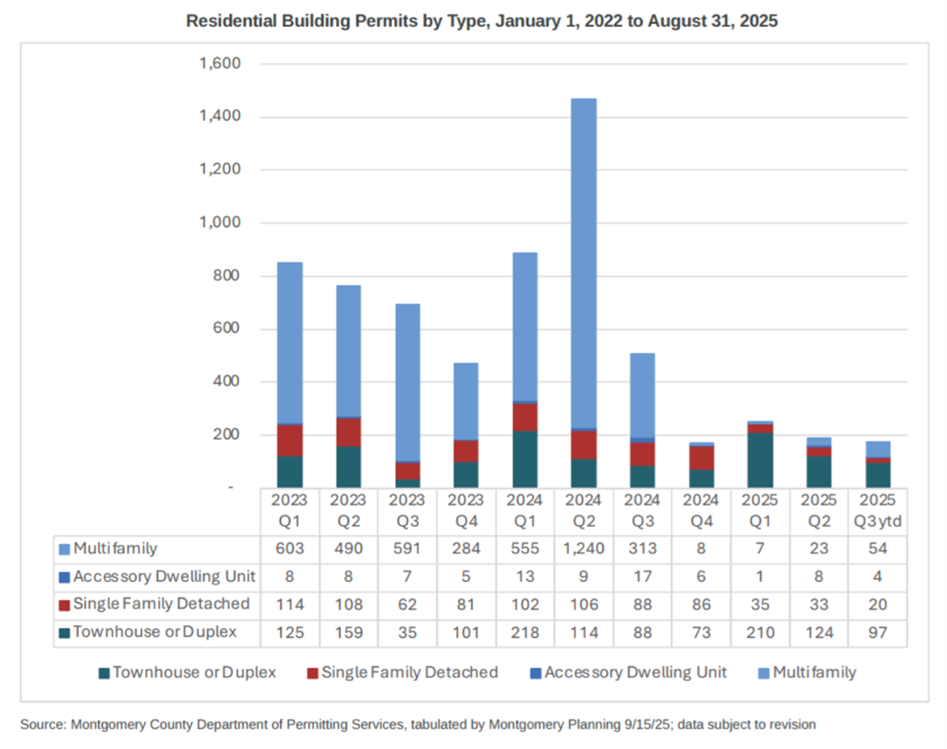

“Rent control has proven to be an all-out disaster for Montgomery County’s multifamily construction market. With almost four quarters of rent control now in the books, average quarterly multifamily permits have dropped by 96%.

“Last summer, data released by the county’s Planning Department showed that during the first three quarters in which the county’s rent control law was fully in effect (2024 Q4, 2025 Q1 and 2025 Q2), MoCo’s number of multifamily units permitted were 8, 7 and 23. In the seven preceding quarters, the number of multifamily units permitted ranged from 284 to 1,240, marking an all-out collapse.

“And while MoCo’s multifamily production had nearly stopped, most other large jurisdictions in the region were producing hundreds of units with three (D.C. and Fairfax and Loudoun counties) topping a thousand.”

Read more about Montgomery County.

Staff Resource

Related Articles

- Housing Coalition Letter to Senate Regarding BTR Inclusion in 21st Century ROAD to Housing Act

- Real Estate Industry Letter to the Senate on Institutional Investment

- Real Estate Industry Statement for HFSC Hearing on Understanding the Policies Behind Rising Costs of Housing and Borrowing

- NMHC RETTC NAA Letter in Support of Housing for the 21st Century

- Real Estate Industry Letter in Support of Housing for 21st Century Act