By Chris Bruen

Chris Bruen Senior Director of Research, with primary responsibility for aiding in and expanding upon NMHC’s research in housing and economics. Chris holds a bachelor’s degree in Finance from The George Washington University and an M.S. in Economics from Johns Hopkins University. He can be reached at cbruen@nmhc.org.

It has never been more expensive to buy a home. A combination of rapid house price appreciation and rising interest rates caused the monthly cost of homeownership to rise 78.0% over the past three years. That’s an average of 21.2% per year—a pace considerably faster than that of rent growth. In fact, by the second quarter of this year, the monthly cost of homeownership for a newly purchased house became $1,298 more than the monthly cost of renting a professionally managed apartment, marking the highest buy-to-rent premium on the record. [1]

As the cost of homeownership becomes more expensive relative to renting, it raises a question as to whether households’ dreams of owning a home are being reconsidered or, conversely, the attractiveness of renting is growing.

To determine whether this shift in demand toward rental housing is truly happening, in this Research Notes, we utilize new data from the forthcoming 2024 NMHC/Grace Hill Renter Preferences Survey to examine:

- how apartment renters differ in their thoughts on homeownership, and

- whether the recent increase in the cost of homeownership has caused a greater share of renters to put off homebuying plans for a later date.

This analysis serves as a preview to the full release of the 2024 NMHC/Grace Hill Renter Preferences Survey Report, which includes responses from roughly 173,000 renters in institutional-grade properties. The survey includes data on a wide variety of renter demographic and psychographic factors, as well as preferences on key customer touchpoints, design features, operational processes and more. The data are available nationally as well as on a local basis for 77 metro markets. The reports provide important supplemental data to investors, market analysts, developers, designers and operational teams.

The report will be released for purchase on November 2, 2023, at nmhc.org/residents.

Almost 1 in 5 Renters Is a Renter by Choice

There has been a lot of discussion in the media around the reasons people rent and whether there are truly “renters by choice,” meaning those who don’t aspire to homeownership and actively choose to rent.

Our survey data show that there is indeed a cohort of renters who plan to remain renters. In fact, more than 17% of apartment residents in 2023 said they simply have no interest in ever purchasing a home, according to data from the 2024 NMHC/Grace Hill Renter Preferences Survey Report. This was on par with the 16.2% who said the same in 2021.

Further analysis shows that these “renters by choice” are overwhelmingly older. More than half (56.4%) were over the age of 54 in 2023 (compared to 10.6% of aspiring homebuyers), and 38.8% were 65 years or older (3.3% of aspiring homebuyers).

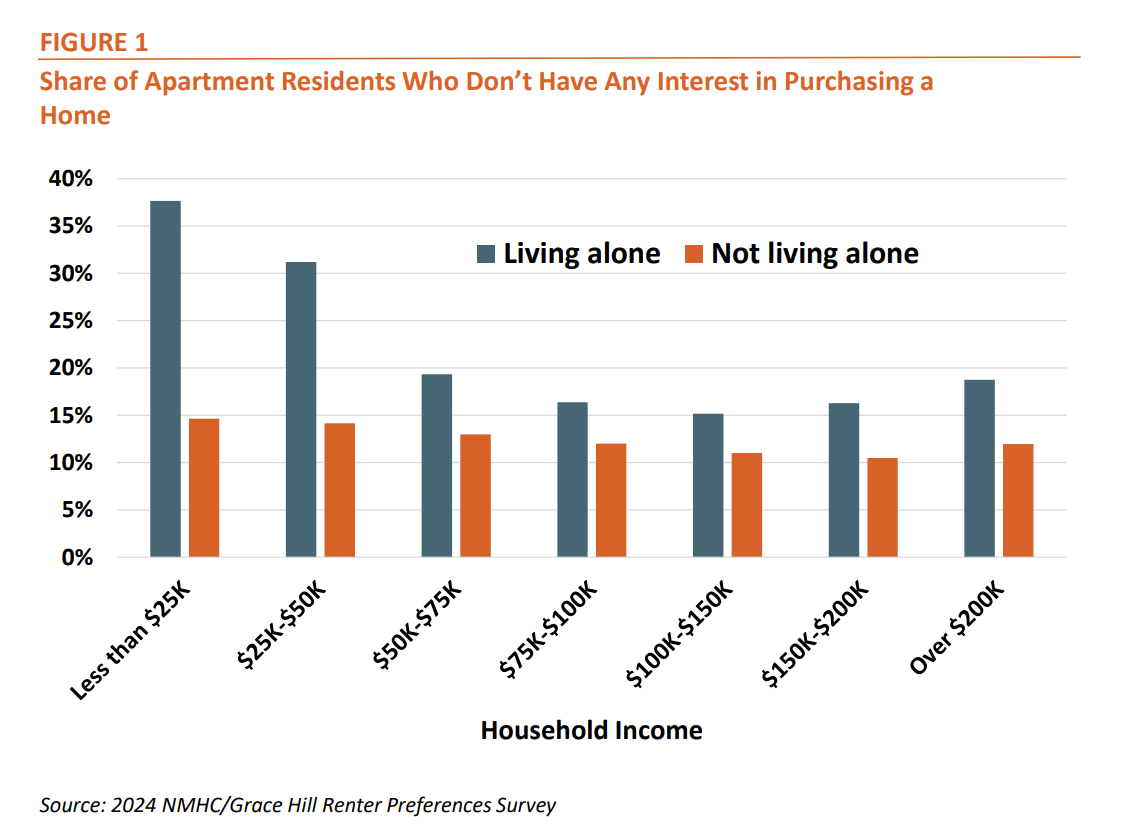

Moreover, apartment residents who lived alone, had lower income and who previously owned a home (23% of respondents) were also more likely to say that they had no intention of ever purchasing a home in the future.

Fewer Renters Say They Are Actively Looking to Buy

Among apartment residents who said they do intend to purchase a home someday—whom we will refer to as “aspiring homebuyers”—we are able to further differentiate between those who are actively looking to buy and those who feel that now is not the right time. Because there has been a sharp increase in the cost of homeownership relative to the cost of renting over the past two years, we might expect there to be a decrease in the share of aspiring buyers who said they are actively looking to purchase a home. This is exactly what we found.

The share of aspiring buyers who are actively looking to purchase a home decreased from 20.5% in 2021 to 18.2% in 2023.

However, to determine whether this decrease is significant, we need to first control for other factors that are likely associated with homebuying—for instance, age, income and living arrangement.

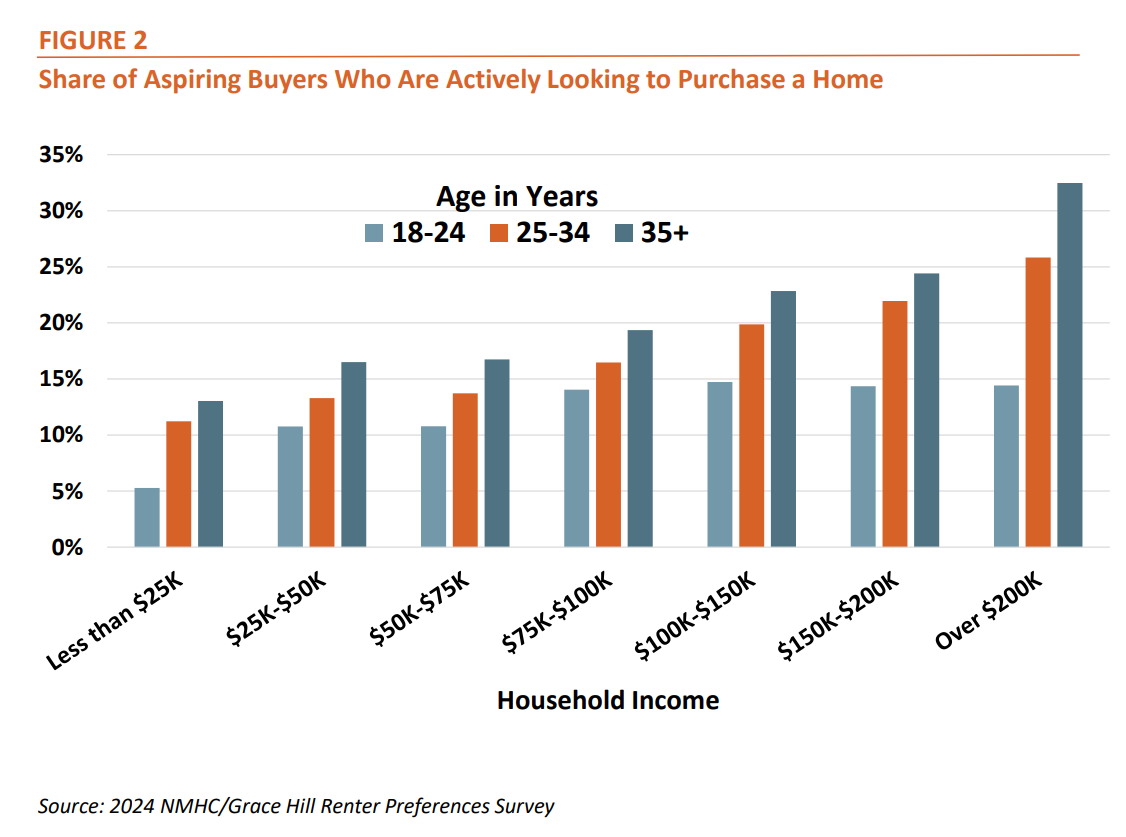

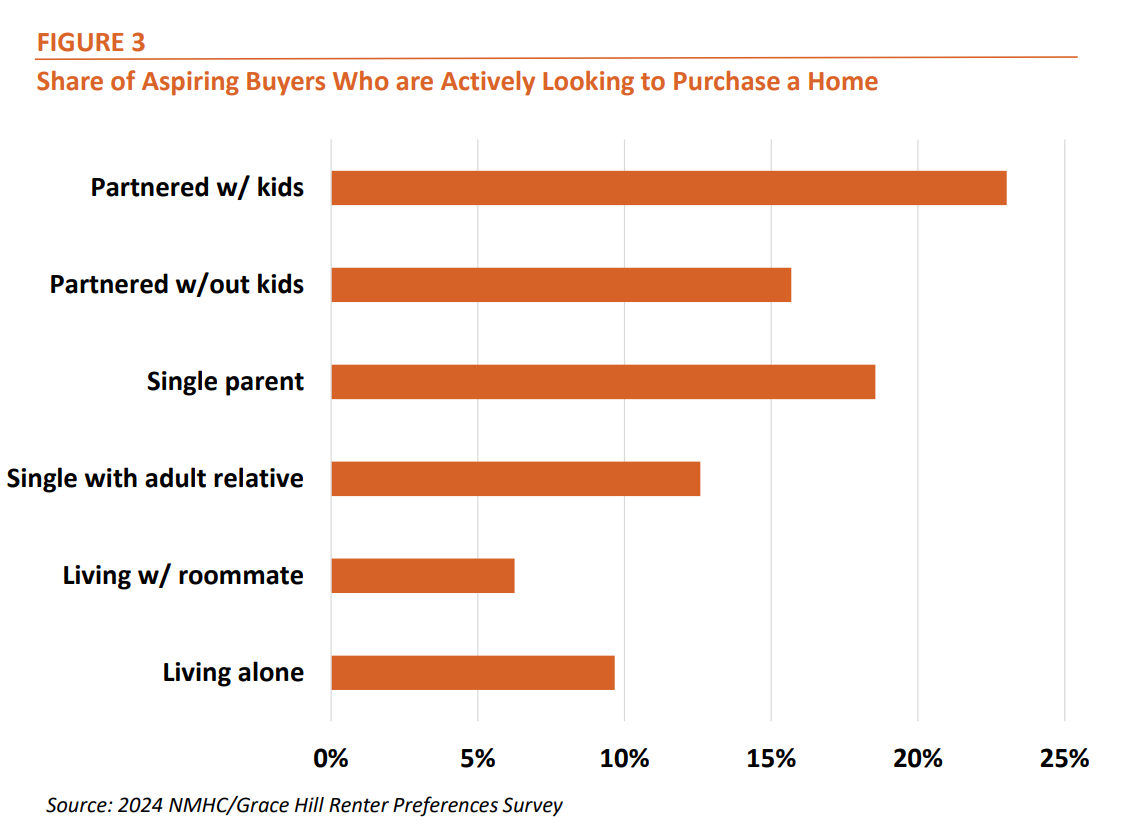

And we find that some of these factors do meaningfully influence respondents’ likelihood of saying they are actively looking to purchase a home. For example, Figures 2 and 3 show that renters who are older, have higher incomes and have children are more likely to be actively looking to buy a home.

But after controlling for age, living arrangement and metro area [2], we still find that aspiring buyers were less likely to be actively looking to purchase a home in 2023 when compared to 2021.

Cost Keeps Some Prospective Buyers on the Sidelines

Even if we know there has been a decrease in the share of aspiring homebuyers what we really want to know is why these apartment residents have delayed their decision to purchase a home. Are these renters being deterred by the rising monthly costs of homeownership relative to the cost of renting, also called the “buy-to-rent” premium? At first glance, it appears that this is the case.

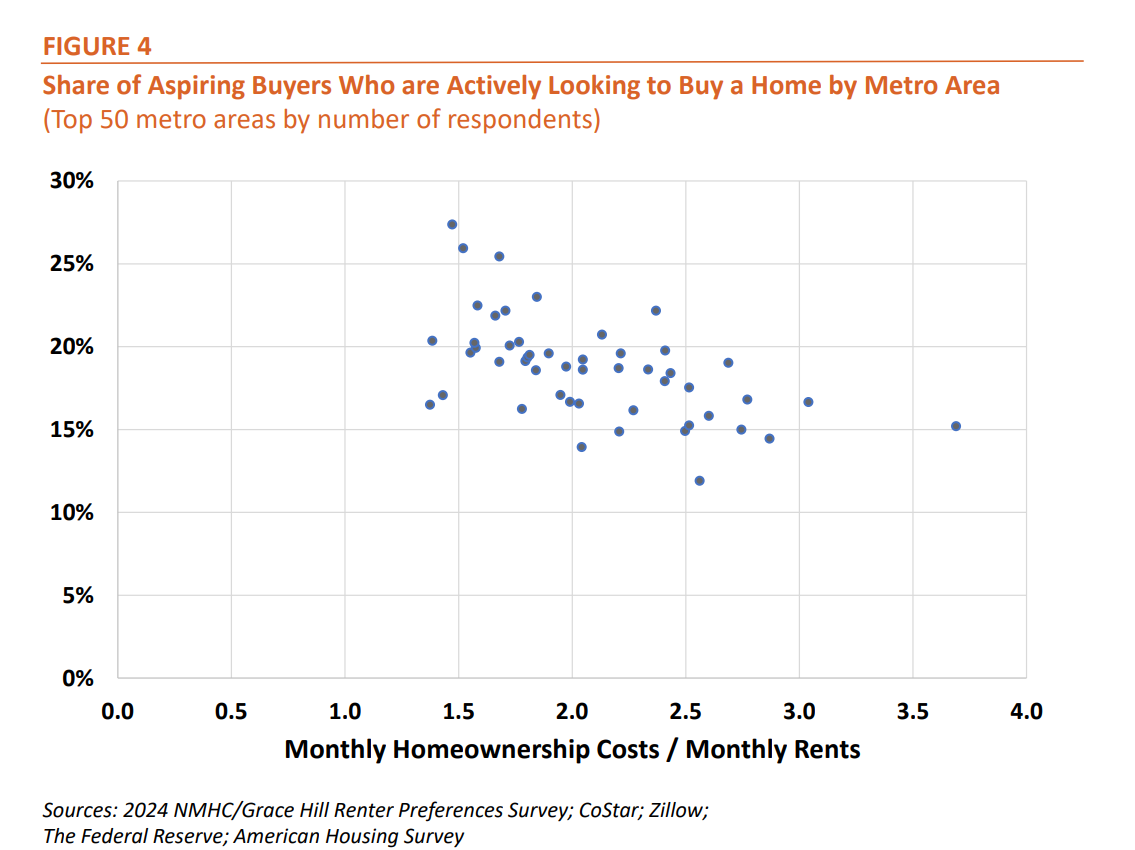

Figure 4 below shows that there is a strong, negative correlation in 2023 between metro areas’ buy-to-rent premium and the share of aspiring homebuyers who are active in the market. In general, the higher the buy-to-rent premium (x-axis) the lower the share of aspiring homeowners who said they were actively looking to buy

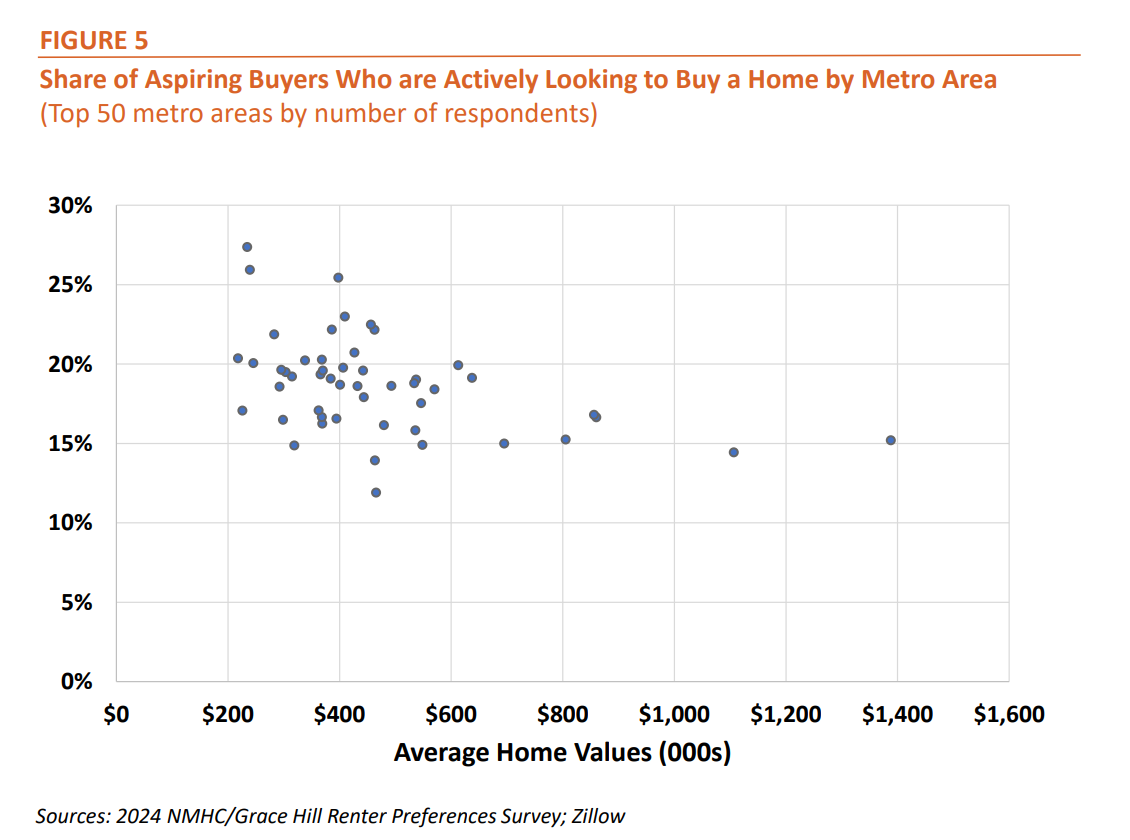

When we look at metro home values as opposed to this ratio of monthly payments, we observe a similar negative relationship. The trend roughly shows the higher the home value, the smaller the share of aspiring buyers who are active on the market.

High Home Prices, Not Buy-to-Rent Premiums Weigh More on Potential Buyers

Are these aspiring homebuyers weighing the relative monthly costs of homeownership and renting or are they simply being deterred by the amount of money they need for a downpayment?

To begin to answer this, we constructed a model that attempts to isolate the effect of each of these metrics, while also controlling for apartment residents’ age, income and living arrangement in 2023.

We find that metro areas with higher average home values tended to have a lower share of aspiring homebuyers who were actively looking to purchase a home. However, the monthly cost of homeownership relative to the cost of rent appeared to have no meaningful impact on buyer sentiment.

Why do prospective buyers seem to disregard this buy-to-rent premium? There are many possible explanations, including:

- Buyers might have the expectation that home values will continue to appreciate. Therefore, even if their monthly costs are higher when compared to renting today, they expect to be in a better financial position in the long term when their home appreciates in value.

- Prospective buyers may anticipate future rent increases, so they are attracted to the idea of being able to fix their monthly home payment well into the future.

- Prospective homebuyers may be looking to become homeowners for reasons that are entirely nonfinancial—for instance, to have the ability to renovate their home to their personal taste.

- Finally, it’s possible that aspiring buyers do account for the cost of homeownership relative to renting but that we are simply unable to observe this behavior due to limitations in either our model or our dataset.

Conclusion

The share of aspiring homebuyers who are actively looking to purchase a house has decreased over the past two years, corresponding to a rapid rise in both house prices and interest rates. However, the exact reason for this decline in home-shopping activity is hardly straightforward.

Our research suggests that aspiring homebuyers are not meaningfully influenced by the comparison of monthly costs between homeownership and renting and, instead, tend to be more responsive to changes in house prices on their own. This could mean that renters who wish to buy a house—and who have the required downpayment—generally seek to purchase a house without much consideration for how this decision will affect their monthly housing payments.

This might seem counterintuitive, but certain rationales could be driving this course of action. Homebuyers might anticipate future home price appreciation or rent increases, such that their home purchase will pay off in the long run. Alternatively, homebuyers who are more driven by the nonfinancial benefits of homeownership may just be willing to tolerate higher monthly payments.

However, one thing we can say with certainty is that the rising cost of housing (both rented and owned) is placing an increasing burden on American households.

- The share of cost-burdened apartment households (those paying more than 30% of their income on housing) increased steadily from 42.4% in 1985 to 57.6% in 2021, according to data from the American Housing Survey. Also, during this period, the share of severely cost-burdened apartment households (those paying more than half their income on housing) increased from 20.9% to 31.0%.

- The share of cost-burdened owner households increased from 19.7% in 1985 to 28.1% in 2021, while the share of severely cost burdened owner households increased from 6.8% to 13.6% during the same timeframe.

Increasing costs are due to a chronic undersupply of housing of all types. Freddie Mac estimated that we were short 3.8 million housing units at the end of 2020. More specific to the rental market, a recent NMHC and NAA study found a shortfall of approximately 600,000 apartment units in 2021.

When we fail to build enough housing, housing costs rise. Not only does this place an increasing burden on American households, but it also contributes to higher overall inflation (housing accounts for a full 40% of core CPI). And, when we fail to address inflation on the supply side, the Federal Reserve must raise interest rates to curb demand. This results in higher mortgage costs for homebuyers and a higher cost of capital for builders and investors, further contributing to our nation’s supply shortage.

- Multifamily starts (5+ units in structure), when looking at a three-month moving average, fell to a seasonally adjusted annual rate (SAAR) of 420,000 units in August, down 19.6% from the prior year.

- According to data from Real Capital Analytics, apartment transaction volume decreased 68% in 2Q 2023 compared to the prior year.

To ease the cost of both rental and owned housing, it is essential that we build more of it and double down on efforts to renovate and preserve our existing, aging stock.

[1] NMHC tabulations of data from RealPage, the National Association of Realtors, The Federal Reserve, U.S. Bureau of Labor Statistics and The American Housing Survey. We assume a 10% downpayment and 30-year fixed rate mortgage. Monthly cost includes mortgage payment, property taxes, PMI and hazard insurance.

[2] We could not control for income because our income categories were not adjusted for inflation.

About Research Notes: Published quarterly, Research Notes offers exclusive, in-depth analysis from NMHC's research team on topics of special interest to apartment industry professionals, from the demographics behind apartment demand to the effect of changing economic conditions on the multifamily industry.

Questions or comments on Research Notes should be directed to Chris Bruen, Sr. Director of Research, NMHC, at cbruen@nmhc.org.